USD Retreats After Softer US Inflation PPI for July

Today the US PPI producer inflation showed a decline from last month, which is contributing to the USD weakness in the US session.

Today the US PPI producer inflation showed a decline from last month, which is contributing to the USD weakness in the US session. Headline PPI inflation fell from 2.7% in June to 2.2% in July, also beating expectations of 2.3%, so traders are expecting other inflation reports to continue the declining trend as well.

This report is important for understanding trends that will be reflected in the upcoming Personal Consumption Expenditures (PCE) report, which includes some of these components from the Producer inflation report. However, today’s PPI data will not likely have a direct influence on the Consumer Price Index (CPI) figures set to be released tomorrow.

US Producer Price Index (PPI) – July 2024 Summary

-

PPI Final Demand:

- Month-over-month (MoM): +0.1% (vs. +0.2% expected)

- Year-over-year (YoY): +2.2% (vs. +2.3% expected)

- Previous month revised to +2.7% YoY (from +2.6%)

-

PPI Excluding Food and Energy:

- MoM: 0.0% (vs. +0.2% expected)

- YoY: +2.4% (vs. +2.7% expected)

- Previous month: +3.0% YoY

-

PPI Excluding Food, Energy, and Trade:

- YoY: +3.3% (revised from +3.1%)

- MoM: +0.3% (vs. +0.1% last month, revised from 0.0%)

Final Demand Breakdown:

-

Goods:

- Overall: +0.6% MoM, the largest increase since February’s +1.1%, with nearly 60% of the rise attributed to energy costs (+1.9%).

- Foods: +1.1%

- Energy: -1.4%

- Goods excluding food and energy: +1.8% YoY

-

Services:

- Overall: -0.2%, marking the largest decline since March 2023, driven by a -1.3% drop in trade services.

- Trade services: +2.7% YoY

- Transportation and warehousing: +0.2%

- Services excluding trade, transportation, and warehousing: +4.2% YoY

-

Construction:

- Prices decreased by 0.6% YoY

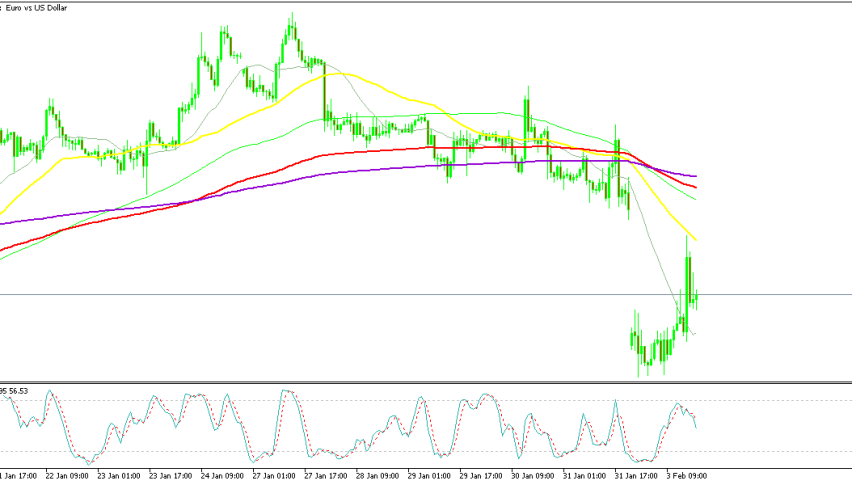

But, treasury yields have declined, with the 10-years down by 2.70% to 3.80%, and the 2-year yield dropping by four basis points, falling below 4%. This decline in yields has weakened the US dollar, with EUR/USD gaining over 40 pips.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |