Japanese Yen Edges Higher as Markets Eye Potential BoJ Rate Hike

The value of the Japanese yen slightly climbed on Thursday as expectations grew that the Bank of Japan (BoJ) will adopt a more aggressive monetary policy approach.

The value of the Japanese yen slightly climbed on Thursday as expectations grew that the Bank of Japan (BoJ) will adopt a more aggressive monetary policy approach.

Especially considering that the nation’s economy grew by more than anticipated in the second quarter of 2024. At this point, Japan’s GDP climbed by 0.8%, marking the largest quarterly gain since 2023 began.

The BoJ may soon contemplate hiking interest rates in order to maintain the economic momentum, according to rumors stoked by this strong economic performance.

JAPAN'S Q2 GDP GROWS BY 3.1% YEAR ON YEAR, BEATING ESTIMATES OF 2.3%

— FinancialJuice (@financialjuice) August 14, 2024

Yoshitaka Shindo, the minister of economy of Japan, expressed hope about the country’s economic recovery and said that increases in household earnings and wages had played a major role in the slow recovery.

In order to develop adaptable macroeconomic policies that can assist the recovery, Shindo stressed the significance of strong collaboration between the government and the BoJ, potentially alluding to additional monetary tightening.

Japan's Economy minister Shindo says wages and income will improvehttps://t.co/idD67ipF83

— ForexLive (@ForexLive) August 15, 2024

Conversely, discussions on the possibility of a September interest rate decrease by the Federal Reserve (Fed) persisted, but the US Dollar stayed robust due to rising Treasury yields.

Discussions on the size of the prospective rate decrease by the Fed have arisen as a result of the most recent US Consumer Price Index (CPI) data indicating a moderate pace of inflation.

Even though a 25 basis point decrease is the most likely option (with a 60% likelihood), there is still a considerable risk (36%) that the Fed will implement a more drastic 50 basis point drop.

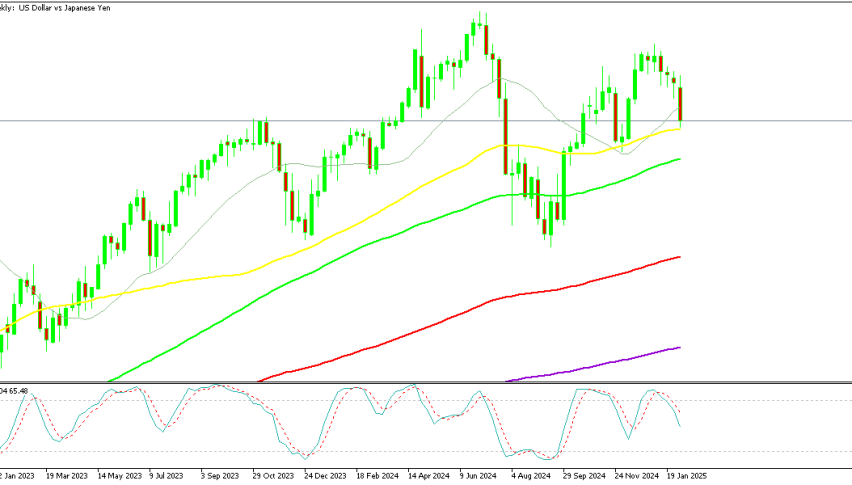

This contradictory mindset has impacted the USD/JPY currency pair since the US Dollar’s sustained strength is ignoring the gains made by the Yen.

The Yen’s movement will be greatly influenced by the market’s prediction of the BoJ’s next actions, especially when Japan’s economic indicators improve.

Nonetheless, the US Dollar’s performance, supported by encouraging economic data and conjecture over the Fed’s policy course, keeps the Yen under pressure.

President of the Federal Reserve Bank of Chicago Austan Goolsbee has drawn attention to the mounting concerns over the US labor market, pointing out that poor job figures have coincided with recent improvements in inflation.

The Fed’s decision-making process regarding interest rate decreases is made more complex by this change in emphasis from inflation to employment.

Federal Reserve Bank of Chicago President Austan Goolsbee says he is growing more concerned about the labor market than inflation amid recent progress on price pressures and disappointing jobs data https://t.co/bRuimFngke

— Bloomberg Economics (@economics) August 14, 2024

The financial markets are expected to be closely monitoring any signs signaling the future direction of Japan’s monetary policy as the parliament of Japan gets ready for a special session on August 23 to review the BoJ’s recent interest rate decision.

The result of these talks and current events in the US will probably continue to affect how the Yen performs in the upcoming weeks.

Japan's parliament to hold Aug 23 special session on BOJ rate hike, sources say https://t.co/o05CANNE18 pic.twitter.com/emmfD4JAF3

— Reuters (@Reuters) August 13, 2024

The Japanese Yen’s recent gains are evidence of growing optimism about Japan’s economic prospects and the possibility of tighter monetary policy by the BoJ.

However, the US dollar’s strength and the Fed’s upcoming measures continue to have a significant impact on the currency’s performance.

These factors are related to the global market. The course that the currency markets take in the near future will be greatly influenced by how the US and Japan manage their different economic challenges.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |