AUDUSD Resumes Downtrend Despite Better China Manufacturing

AUDUSD bounced higher this week, but the decline has resumed again despite improving manufacturing and services in China,

AUDUSD bounced higher this week, but the decline has resumed again despite improving manufacturing and services in China, as the PMI and Caixin report showed. The USD has been retreating this week, but the Aussie couldn’t take advantage of that, which points to further declines toward this year’s low.

AUD/USD dropped below 0.66 this week after a brief rally, as selling pressure resumed with commodity-linked currencies, including the Aussie, underperforming. Weekend data from China revealed a sharp 27% drop in industrial earnings for September, following a significant decline in August. Although manufacturing and services PMI figures hinted at some improvement earlier in the week, the Australian dollar still slid below 0.6550, opening the path to 2024 lows near 0.6350.

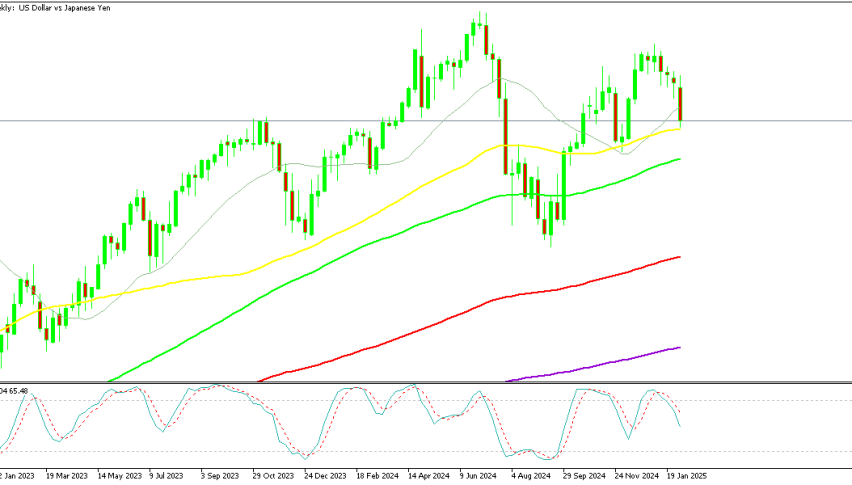

AUD/USD Chart H4 – The 50 SMA Rejected the Bounce

Sellers are now focused on the 0.6350 level unless AUD/USD can break above the falling channel and reclaim the $0.6600 level—something it struggled to do during the recent retracement, with the 20-day SMA providing resistance again. The pair has seen a steady decline this month, falling by 4 cents due to a stronger US dollar and reduced demand for commodity-based currencies like the Australian and New Zealand dollars.

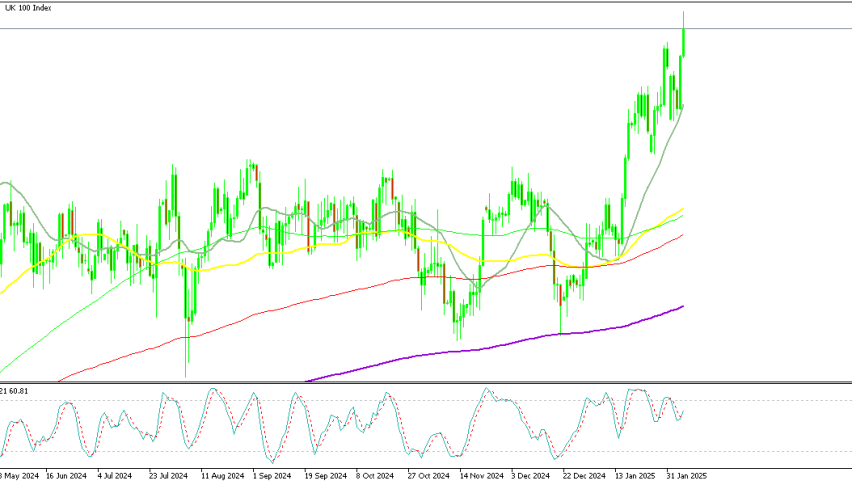

China Caixin Manufacturing PMI for October

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |