FTSE Declines After Surprise GDP Growth Dampens BoE Hopes

GDP expanded in the last quarter of 2024 in a show of resilience in the UK economy. The FTSE reacted with a selloff.

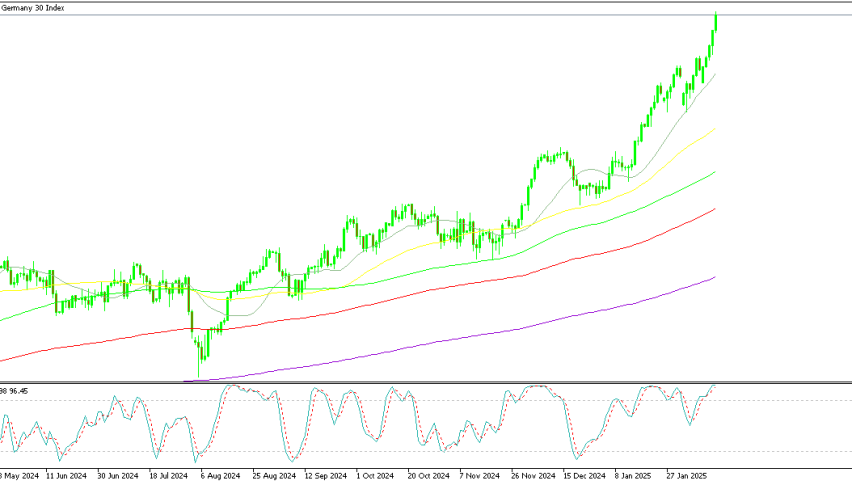

Live FTSE Chart

GDP expanded in the last quarter of 2024 in a show of resilience in the UK economy. The FTSE reacted with a selloff.

- UK GDP QoQ expanded by 0.1%

- Growth was led by the services sector

- Challenges still remain

The FTSE dropped 500 points or 1% after the data for GDP was released this morning. The data showed a positive surprise, beating forecasts for a contraction in the last quarter. The trend is in contrast to European peers which have rallied today on talk of a Ukraine peace deal.

GDP Growth Shows Resilience

UK GDP Growth beat forecasts of -0.1% to print at 0.1% expansion for Q4 2024. The YoY growth for Q4 was also higher at 1.4%, beating predictions of 1.1%.

Overall, GDP growth for 2024 came in at 0.9% for the FY 2024 after 2023 showed growth of 0.4%.

Today’s number shows the UK economy may be more resilient than thought. Last week the BoE reduced its growth forecast for 2025 to 0.75% from 1.5 %.

However, the National Institute of Economic and Social Research has kept its forecast for 1.5% growth in 2025.

An interesting and often overlooked data is the per capita production. The UK population is growing, and per capita growth fell by 0.1% in 2024, raising concerns about living standards.

FTSE Live Chart

BoE and the Cause for a Rally in the FTSE

The FTSE rally has predominantly been fueled by hopes for dovish policy from the central bank. Interest rates are playing a key part in the current momentum higher in the index.

I have often mentioned this, it’s more of an interest rate play than a pure growth play. Companies with high debt ratios will find that financing their debt load is cheaper with lower rates.

The cheaper money allows for less profits being used to finance the debt. Automatically, all things equal, the company becomes more profitable as it saves a lot of cash on financing debt.

Therefore, we se that positive news of economic expansion are not always met well by the broader stock market.

A moderately expanding economy is enough to keep companies in the black, and cheaper financing will simply boost profits.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |