Lagarde Confirms the Weakness in the Eurozone, But No Action on the Euro

Unlike Draghi, ECB's Lagarde doesn't jawbone the Euro down

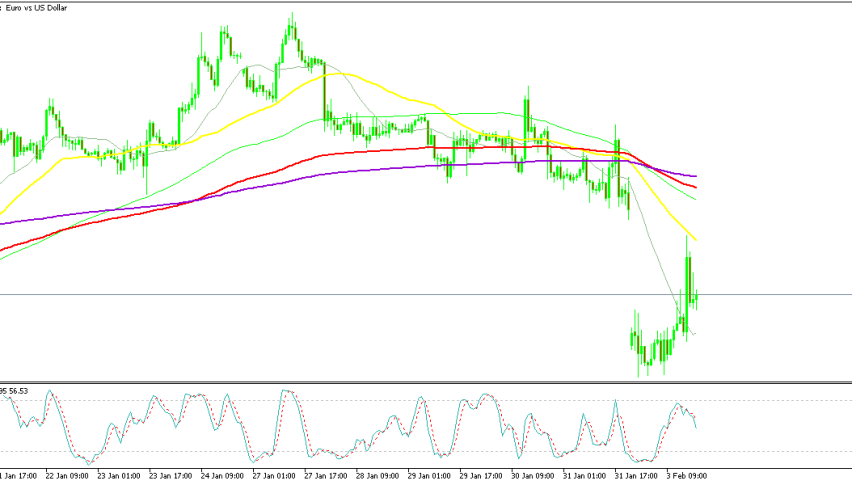

The Eurozone recovery has run into a dead end now, after a decent jump in May and June. All economic indicators are showing increased weakness, with services falling into contraction again in September, as today’s services reports showed. ECB president Christine Lagarde spoke earlier today, confirming the economic weakness, but added that the exchange rate is not in the ECB mandate. The Euro has been bullish this week, as markets wait for the US stimulus package to come. So, no threats from the ECB and the EUR/USD continues to push higher today.

Comments by ECB president, Christine Lagarde

- Recovery is incomplete, uncertain, uneven

- Fears that instead of a V-shaped recovery, the rebound will be more shaky

- Don’t see a complete recovery until the end of 2022

- Fiscal, monetary policies must work hand in hand

Further remarks by Lagarde

- ECB’s Lagarde repeats that they will not target the euro exchange rate

- ECB is ‘very attentive’ to exchange rate developments

- ECB hoping for the best, preparing for the worst on Brexit

And that will be the tagline by the ECB throughout this whole ordeal, but one can certainly expect some indirect jawboning if policymakers do feel uncomfortable about the euro.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |