GBP/USD EMA Crossover – UK GDP Coming Up Next!

Technically speaking, the Cable should go after the C to D wave which starts below $1.4295 and completes near $1.3300...

Recalling our March 29 – Economic Events Outlook article, the UK economy is all set to release the Q4 GDP and Current Account data. It is going to be very exciting to trade Sterling to catch some quick profits. Let’s take a look at the trade plan…

GBP/USD – Bullish Butterfly Pattern

I spotted another pattern on the 4-hour chart of GBP/USD. It is a Bullish Butterfly Pattern which has completed the B to C wave near $1.4295. It is the same level that we identified a couple of days ago.

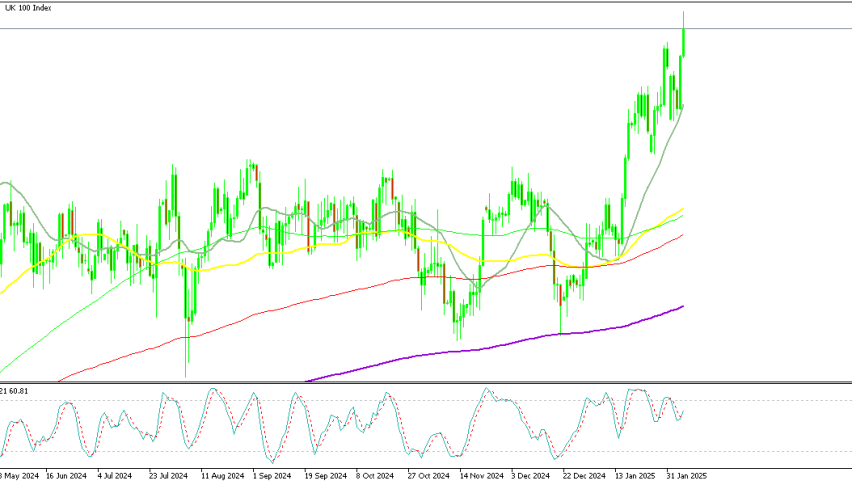

GBP/USD – Daily Chart

GBP/USD – Daily Chart

Technically speaking, the Cable should go after the C to D wave which starts below $1.4295 and completes near $1.3300. Today, the GDP and current account figures will determine the direction of the pair.

On the 4-hour chart, the GBP/USD is showing a bearish crossover of the 50 EMA. This signifies the bearish bias of traders. Learn more about FX Leaders EMA Strategy to take highly profitable trades.

GBP/USD – Key Trading Levels

Support Resistance

1.4069 1.4167

1.4038 1.4198

1.3989 1.4247

Key Trading Level: 1.4118

GBP/USD Trading Plan

The idea is to stay bearish below 1.4120 with a stop above 1.4150 and take profit of 1.4025. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |