Central Bank Monetary Policy Impacts Market Trust in Currency: Kuroda

Investor confidence in the central bank is the main driver influencing market trust in the Yen.

•

Last updated: Thursday, May 9, 2019

Bank of Japan Governor Kuroda addressed the Japanese Parliament, stating that investor confidence in the central bank is the main driver influencing market trust in the Yen.

According to Kuroda, exchange rate fluctuations are not enough of a factor for market trust in the yen. The power of a currency depends on several other factors beyond how its price varies when compared with other currencies.

Investor confidence in a central bank’s monetary policy also has a significant role to play in determining the true value of a nation’s currency.

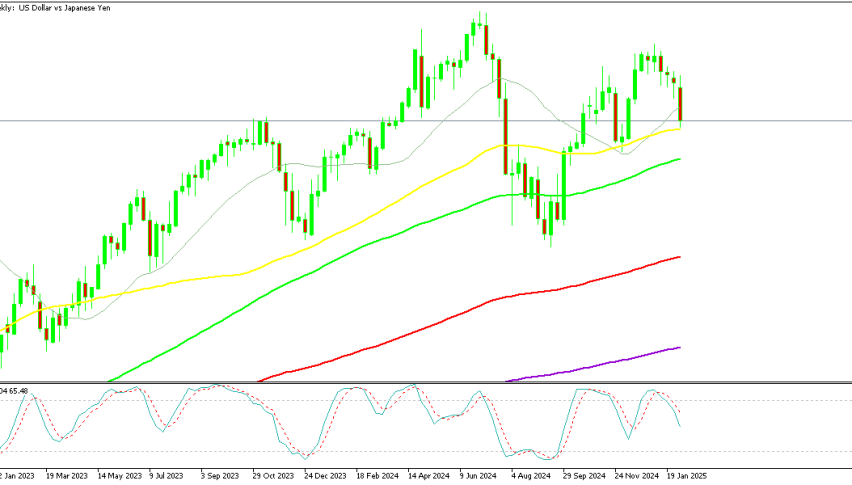

USD/JPY has been trading lower today at 109.93 after dropping below 110, at the time of writing.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Index & Commodity Analyst

improve security

Related Articles

Sidebar rates

Start Trading

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |