US Dollar Weak as Coronavirus Relief Bill Makes Progress

The weakness in the US dollar continues into early trading on Thursday as markets trade with a risk-on sentiment in anticipation of the

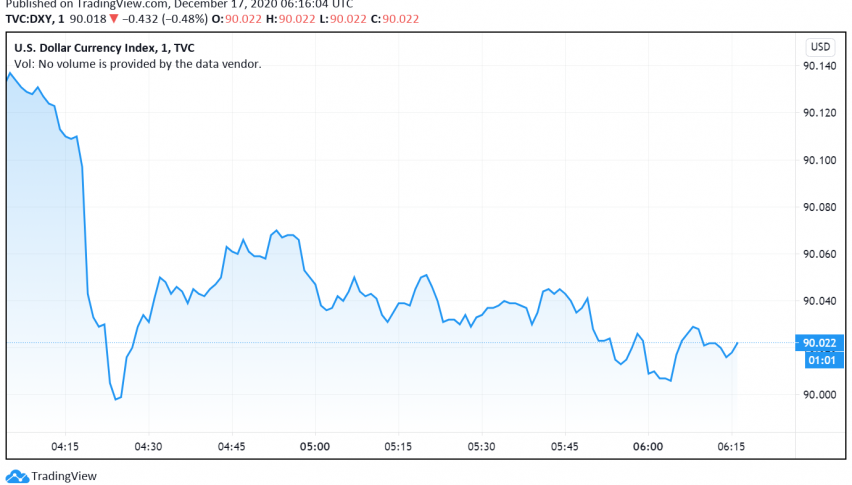

The weakness in the US dollar continues into early trading on Thursday as markets trade with a risk-on sentiment in anticipation of the coronavirus relief package in the US and the possibility of a Brexit deal. At the time of writing, the US dollar index DXY is trading around 90.02.

According to latest news reports, lawmakers in the US Congress are close to reaching an agreement on a coronavirus relief bill worth $900 billion. The latest round of stimulus measures include direct payments to Americans as well as unemployment benefits, and are aimed at supporting the US economy that has suffered due to the pandemic.

The safe haven appeal of the US dollar also came under pressure after the European Commission President Ursula von der Leyen confirmed that negotiations between Britain and the EU on the post-Brexit trade deal had made progress. In addition, Conservative Party lawmakers in the UK are also hopeful that a trade deal could be worked out with the EU before the transition period deadline.

During the previous session, the US dollar experienced some bullish movement following the conclusion of the latest FOMC meeting, in which the Fed reiterated its commitment to low interest rates. However, the dovish stance of keeping rates low until the US economy’s recovery is secured weakened the greenback a little later to the lowest level since April 2018.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |