USD/JPY Surges as US Dollar Dominates; Fed Minutes Impact and Technical Analysis

The USD/JPY pair witnessed a significant upswing on Wednesday, with the US Dollar outperforming against the Japanese Yen.

The USD/JPY pair witnessed a significant upswing on Wednesday, with the US Dollar outperforming against the Japanese Yen. The pair experienced a notable 1.33% rise, momentarily touching just below 143.75, before settling above 143.00.

This movement reflects the market’s reaction to the Federal Reserve’s December meeting minutes, which suggested a more cautious approach to rate cuts than anticipated. Contrary to expectations for immediate rate reductions, Fed officials indicated the possibility of maintaining higher rates for a more extended period.

The upcoming Asia market session anticipates China’s Caixin Services PMI, expected to show a slight increase, which could enhance market optimism. This positive sentiment aligns with the recent Caixin Manufacturing PMI, exceeding forecasts and signaling potential uplift in risk appetite.

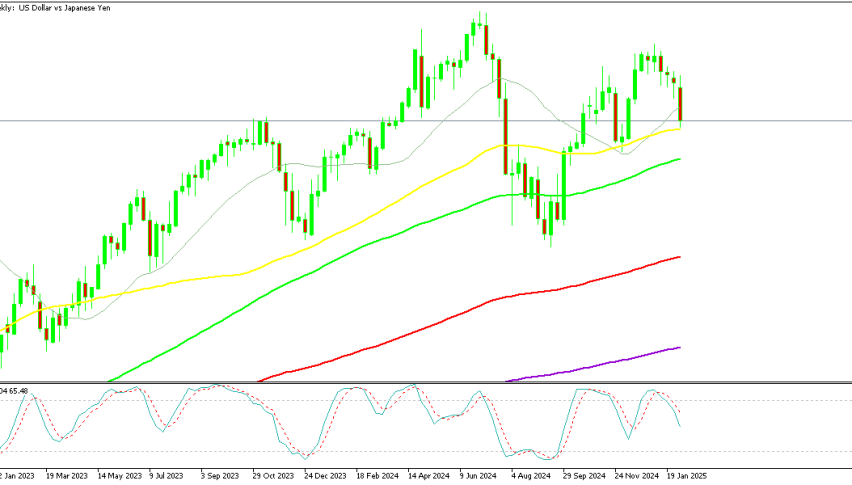

USD/JPY Technical OutlookFor the USD/JPY technical outlook, the pair’s strong rally past 142.35 suggests a bullish trend, targeting further gains towards 144.90 and 145.90.

USD/JPY Technical OutlookFor the USD/JPY technical outlook, the pair’s strong rally past 142.35 suggests a bullish trend, targeting further gains towards 144.90 and 145.90.

The bullish bias is supported by the pair’s position above the EMA50, though a break below 142.35 could reverse this trend. Today’s expected trading range is between 142.70 support and 144.30 resistance, maintaining a bullish perspective for the day.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |