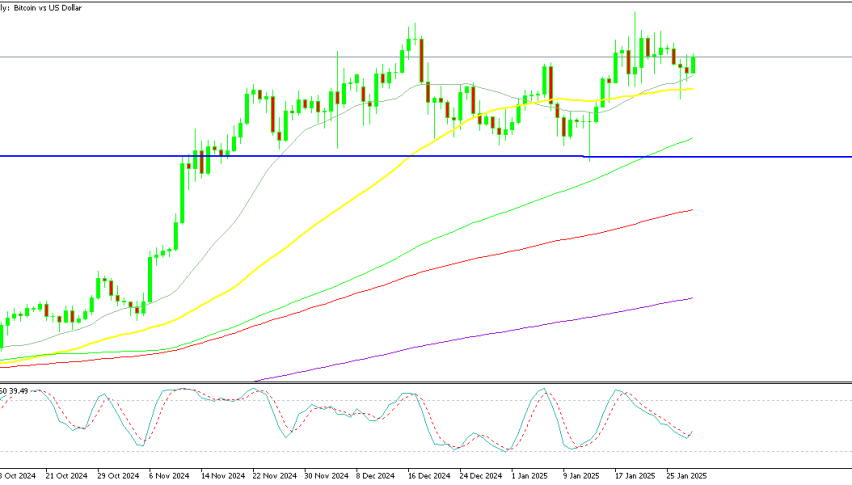

US PCE Inflation in Downtrend, But FED Not In Rush to Cut Rates

US PCE inflation resumed the downtrend, as Friday's data showed, but the FED didn't seem moved by it and is keeping the higher rates bias.

The US PCE inflation resumed the downtrend, as Friday’s data met expectations, leading to some dollar selling. There were plenty of expectations for this report since the FED prefers the PCE instead of the CPI which was keeping markets at a standstill, but at the end of the day and the end of the week, the USD was little changed.

Headline PCE was flat month-over-month, with the unrounded value at -0.0081%, suggesting mild deflation. Core PCE rose by 0.083% month-over-month. Personal income data showed a slightly higher increase of 0.7%, while personal consumption grew by 0.2%, below the expected 0.3%, with a downward revision of 0.1 percentage points for the previous month. The USD initially dropped a little but then recovered.

The US PCE Inflation Report for May 2024

- Core PCE:

- May core PCE increased by 0.1% month-over-month, matching expectations.

- The prior month’s core PCE was revised up from 0.2% to 0.3%.

- Year-over-year core PCE rose by 2.6%, in line with estimates.

- Headline PCE:

- Headline PCE was flat month-over-month, as expected.

- Year-over-year headline PCE increased by 2.6%, meeting expectations.

- Personal Income and Spending:

- Personal income increased by 0.5%, slightly above the expected 0.4%.

- Personal spending grew by 0.2%, just below the anticipated 0.3%.

- The prior month’s personal spending was revised down from 0.2% to 0.1%.

- PCE Services:

- PCE services excluding energy rose by 0.1%, compared to 0.3% in the previous month.

Comments from the SF Fed President

-

Positive Outlook on PCE Data:

- Daly stated that the recent PCE data is ‘good news’ but emphasized that the Federal Reserve’s work is not finished yet.

-

Monetary Policy Impact:

- She acknowledged that it’s taking longer for the current policy to have its full effect, but it’s indeed working as intended.

-

Future Actions:

- Daly mentioned that she is considering various scenarios and the Fed will respond accordingly. It’s still too early to determine specific actions.

-

Inflation Trends:

- The recent inflation data indicates a cooling trend, suggesting that the current policy is effective.

-

Impact of Generative AI:

- While she anticipates that generative AI will boost productivity, it’s premature to make definitive predictions about its impact.

-

Inflation Outlook:

- Daly predicts that inflation might continue to print above 2%, potentially through 2025.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |