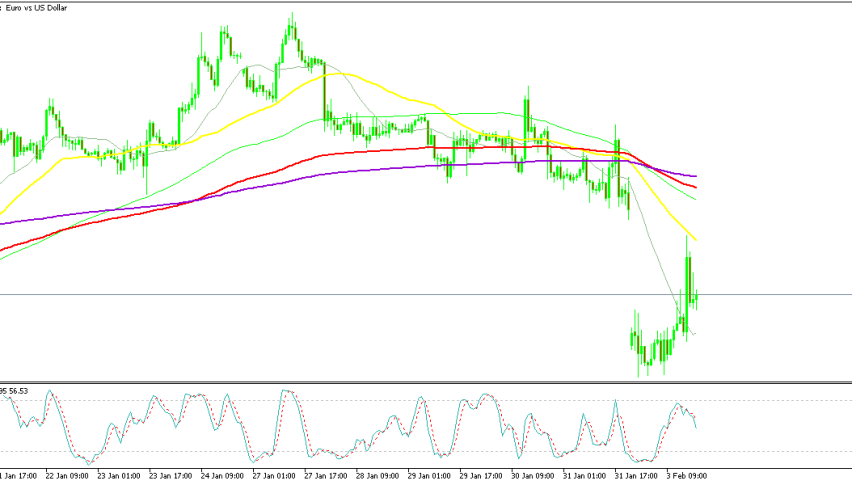

DAX Continues Decline on Hawkish ECB and U.S. Market Correction

The ECB press statement was overall hawkish warning of persistent inflation and uncertain economic performance.

The ECB press statement was overall hawkish warning of persistent inflation and uncertain economic performance.

The Eurozone central bank kept interest rates on hold, as the market had widely expected. No real news from the event. What was more interesting was the forward guidance made in the post-meeting press statement.

The ECB president Lagarde said that inflation remains persistently high, and that the ECB will maintain rates high as long as necessary. She also mentioned the usual comment to act on data, an approach based on the inflation outlook.

Lagarde also mentioned a weaker economic outlook with slower expansion in the second quarter compared to the first quarter. Overall, the ECB expects muted growth for 2024 amid uncertainty.

The market saw little reason to react to the press conference, gaining just 0.2% in the first half hour after the Lagarde started her speech. However, the DAX turned south after the U.S. open following the major New Stock indices lower.

Technical View

The day chart below for DAX shows a market still in a bullish trend undergoing a severe correction. Today’s candle has found support on the belly of the Ichimoku cloud at 18,166. To consider the bull trend back in action we need to see the market rise above the cloud.

That alone would not be enough, the latest attempt to rally higher failed at 18,785 (blue line), from there the market turned back down again. So, we would also need the market to close above the blue line, and then continue past its all-time high of 18,913 (red line) for confirmation of the trend.

To the downside the initial support remains at the bottom of the cloud. Should that break the next support is at the previous low of 17,939 (green line).

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |