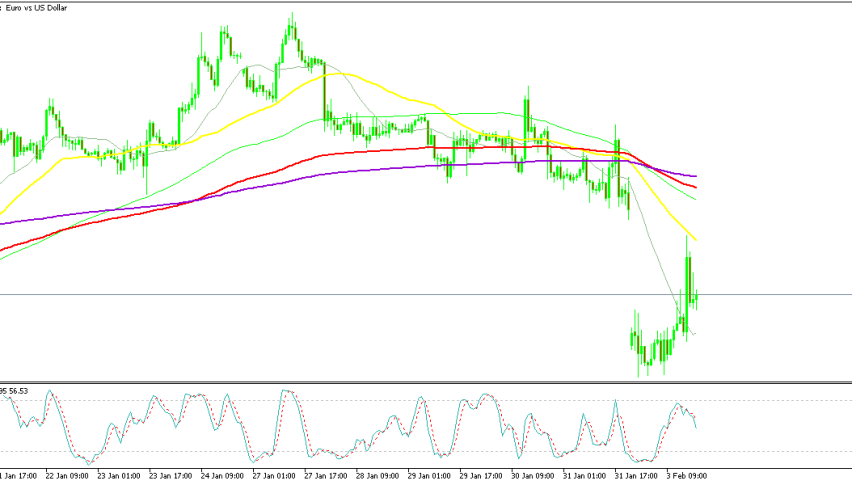

USD Resumes Decline As Powell Confirms FED’s Dovish Shift

Powell's Jackson Hole speech was highly anticipated, and it certainly didn't disappoint, sending the USD on another bearish leg down.

Powell’s Jackson Hole speech was highly anticipated, and it certainly didn’t disappoint, sending the USD on another bearish leg down. While many market participants expected him to signal a rate cut, Powell went further, stating clearly that the Fed would do everything possible to maintain a strong jobs sector.

Powell at Jackson Hole: Key Highlights

- Policy Adjustment: Powell stated, “The time has come for policy to adjust,” signaling a shift in monetary policy. The direction is clear, but the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

- Labor Market Focus: The Fed does not seek or welcome further cooling in the labor market. Powell emphasized the commitment to supporting a strong labor market while making progress toward price stability.

- Dovish Stance: Powell’s comments are clearly dovish. He expressed increased confidence that inflation is on a sustainable path back to the 2% target.

- Inflation Risks: The risks of inflation have diminished, while the risks to employment have increased. Powell noted that inflation is now “much closer to goal.”

- Labor Market Cooling: Powell acknowledged that the cooling in labor market conditions is “unmistakable.”

Additionally, he didn’t refuse the possibility of a significant rate cut of 50 basis points, the market took that as pretty dovish. As a result, the US dollar experienced a sharp decline, which continued until the close, while equity markets saw a strong rally. Closing times that day varied:

Stock Market Performance at Friday Close:

- S&P 500: Closed up by +1.2%, reflecting investor optimism after Powell’s speech at Jackson Hole.

- Nasdaq Composite: Gained +1.5%, led by strong performances in technology stocks.

- Dow Jones Industrial Average (DJIA): Increased by +1.2%, driven by gains across various sectors.

- Russell 2000: Surged by +3.1%, indicating robust investor interest in smaller, more economically sensitive companies.

- Toronto TSX Composite: Rose by +1.1%, reaching a record high, supported by strong performances in energy and financial sectors.

Weekly Performance:

- S&P 500: Up by +1.4% for the week, continuing its upward trend as investors remain bullish on the economic outlook.

- Nasdaq Composite: Also up by +1.4% over the week, buoyed by positive sentiment around tech sector earnings and innovation.

- Dow Jones Industrial Average (DJIA): Increased by +1.3% for the week, reflecting solid performance in blue-chip stocks.

- Russell 2000: Advanced by +3.4% over the week, showing significant gains in small-cap stocks, which often signal economic optimism.

- Toronto TSX Composite: Up +4.1% for the week, marking a strong performance, especially in resource-related stocks, amid positive global economic indicators.

The US dollar has weakened considerably after Powell finally excepted and officially annuonced a shift in monetary policy. Powell emphasized the importance of maintaining a robust labor market, which sent US stocks soaring. Despite this, it appears that the markets had already anticipated much of Powell’s message, given that stocks had risen in nine of the eleven days leading up to the speech. Nevertheless, further buying opportunities are expected if the Fed implements the suggested changes.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |