Bitcoin Price Drops Below $54K Amid Jobs Report and Fed Rate Cut Speculation

Bitcoin (BTC) saw significant volatility on Friday, briefly surging to $57,000 before plunging below $54,000 following the release of the U.S. nonfarm payrolls report.

Bitcoin (BTC) saw significant volatility on Friday, briefly surging to $57,000 before plunging below $54,000 following the release of the U.S. nonfarm payrolls report.

This sharp price swing led to over $50 million in liquidations across crypto derivatives markets, primarily targeting leveraged long positions.

By the end of the day, Bitcoin was down nearly 3%, hitting its lowest price since early August. Major altcoins, including Ether (ETH), Solana (SOL), and XRP, also posted losses of 2%-4%.

U.S. Jobs Data and Fed Rate Cut Anticipation

The U.S. added 142,000 jobs in August, slightly below analysts’ expectations, while the unemployment rate fell to 4.2%.

This data has further fueled speculation about the Federal Reserve’s upcoming interest rate decision at its September 18 meeting. Currently, market participants see a 70% chance of a 25 basis-point cut and a 30% probability of a larger 50 bps cut.

Fed Governor Christopher Waller supported lowering interest rates, stating, “The time has come to lower rates,” and indicated he would advocate for “front-loading cuts” if necessary.

However, some analysts argue that a smaller cut might be more favourable for risk assets like Bitcoin, as a larger cut could signal deeper concerns about the economy.

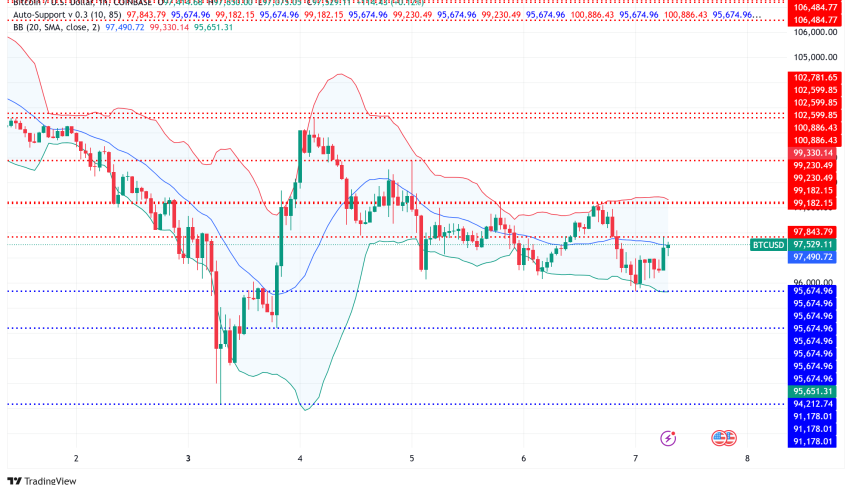

Technical Analysis: Bitcoin’s Key Levels to Watch

Bitcoin is currently testing crucial support levels. The Relative Strength Index (RSI) is hovering around 35, suggesting Bitcoin is in oversold territory and may see a bullish bounce.

However, resistance lies at $55,250, and if Bitcoin fails to break above this level, selling pressure may resume. A drop below $53,350 could push the price down to the next support at $51,720.

- RSI: Rebounding from 35, indicating possible upside potential.

- Resistance: $55,250 is the immediate level to watch.

- Support: Key support sits at $53,350, with further downside possible to $51,720.

Conclusion: Will Bitcoin Break Through or Fall Further?

Bitcoin’s price remains in a tight range, with critical levels to watch at $55,250 on the upside and $53,350 on the downside.

Traders should monitor these resistance and support zones as the market continues to react to macroeconomic data and Federal Reserve decisions.

A break above resistance could signal a potential recovery, while a dip below support may lead to further losses.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |