EUR/USD Price Forecast: Holds Above Key Support at 1.1150; Fed Rate Cut Expectations

During Friday's European trading session, the EUR/USD pair continues to show strength above the 1.1150 level. The primary driver behind

During Friday’s European trading session, the EUR/USD pair continues to show strength above the 1.1150 level. The primary driver behind this momentum is the weakening of the U.S. dollar (USD), as the U.S. dollar index (DXY) hovers above its year-to-date low of 100.21.

Following the Federal Reserve’s recent decision to cut interest rates by 50 basis points, the USD has seen a notable decline, and expectations are rising that the central bank will maintain an aggressive policy-easing stance.

With inflation declining toward the Fed’s 2% target, policymakers are now focusing on labour market recovery.

Current projections show the federal funds rate will likely end the year at 4.4%, according to the Fed’s dot plot, though market sentiment suggests further rate reductions could bring it to 4.00%-4.25%.

Intraday Update: $EURUSD is getting into one of those "poop or get off the pot" moments up here regarding the 1.12.

We haven't really retested it so unless we do, there's a growing risk some longs get fed up and get out.

To counter that though, the bounce off the 1.1070's… pic.twitter.com/q3gZ7hrqiF

— Forex Analytix (@forexanalytix) September 20, 2024

This ongoing debate between market expectations and Fed guidance is keeping the EUR/USD pair in focus for traders.

Eurozone and U.S. Data to Watch

The Eurozone’s preliminary consumer confidence reading, expected later today, will offer further insight into regional economic sentiment.

Analysts forecast a slight improvement to -13 in September from -13.5 in August. Any unexpected movement in this index could influence the Euro’s strength in the short term.

US easing cycle to weaken dollar, help euro to rise: UBShttps://t.co/oYTRlBXud0 pic.twitter.com/3jLuege9tg

— Streetinsider.com (@Street_Insider) September 19, 2024

Later in the day, Philadelphia Fed Bank President Patrick Harker is scheduled to speak, and investors will be closely watching for any fresh insights on U.S. interest rates. His comments could potentially impact the USD, and in turn, the EUR/USD pair.

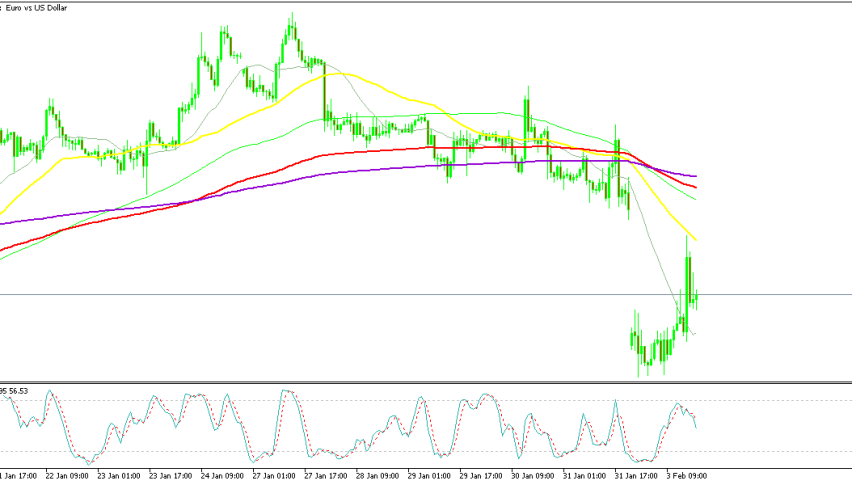

EUR/USD Price Forecast

The EUR/USD pair is currently trading at $1.11580, maintaining its bullish outlook. After rebounding from the 50-day Exponential Moving Average (EMA) at $1.11105, the pair is poised to test immediate resistance at $1.11787. A break above this level could lead to further gains, targeting $1.12090 and $1.12330.

Support on the downside is located at $1.11335, and a stronger support zone is close by $1.11105, which is in line with the 50-EMA.

The RSI sits at 58.65, indicating moderate bullish momentum but also suggesting the possibility of a short-term consolidation before the next leg higher.

Key Insights:

Resistance: EUR/USD faces immediate resistance at $1.11787; a break could push prices toward $1.12090.

Support: The 50-day EMA at $1.11105 offers solid support, keeping the bullish trend intact.

RSI: At 58.65, the RSI reflects moderate bullish momentum, with room for further gains. However, a brief consolidation phase is possible.

Overall, the EUR/USD pair maintains its bullish stance amid a weaker dollar and supportive technical indicators, but upcoming data releases could add volatility to the market.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |