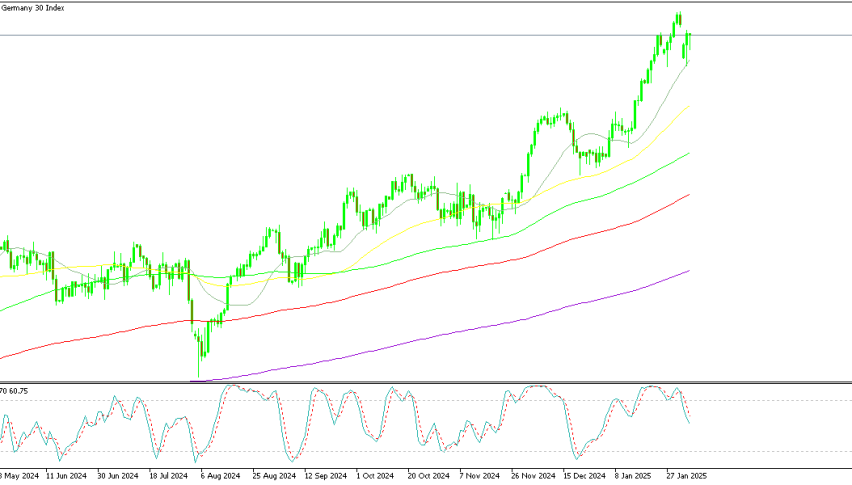

Energy Stocks Lead European Markets Higher

Leading indices recover some of this week’s lost ground as a rise in energy prices fuel energy stocks’ rally.

Leading indices recover some of this week’s lost ground as a rise in energy prices fuel energy stocks’ rally.

Energy stock price jumped Friday as Iran announced plans to attack Isreal. USOIL has gained $4 per barrel since its low on Tuesday. Energy stocks have helped the DAX gain 0.5% on the day and the CAC 0.64%.

The week is set to close with losses for these markets as they are both down over 1% on the week. The market expects ECB interest rate cuts to continue, however, concerns are mounting as to policy loosening coming too late.

The Fed meeting is next week with the market pricing in another 0.25% cut in rates. The CME Fed Watch tool calculates a 93.1% probability of another 25 basis point cut. However, lackluster earnings reports from the magnificent seven have raised concerns about revenue projections.

Apple reported earnings last night and showed that the company missed its estimate for Q4 earnings. The tech company attributed the lack in performance to a decline in sales from China.

UK Budget Hits BoE Policy

The UK Budget, announced Wednesday, has started to take its toll on the markets. Gilt prices are down 1.37% from Wednesday, on concerns about how the government will finance its extra spending.

The extra spending is likely to increase yields across the bond curve. The pressure on yields would also limit the capability of the central bank to act on reducing interest rates. The UK stock market has also been hit by the turmoil of excessive government spending.

The FTSE has recovered today from this week’s lows, buts is currently down 1.5% on the week. The promise of higher corporate taxes, social security contributions, and a likelihood of higher rates for longer, are probably not going to play out well for stock investors.

To close the week, the main event is Non-Farm Payrolls later on today. Analysts expect a number of 113k new jobs. But also believe that a variation from that forecast will not influence the Fed policy at the November 7, FOMC meeting.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |