No Hope for the (Euro) EUR As Eurozone Economy Keeps Underperforming

The Euro (EUR) was having a nice time during July and August, but now the tide has turned and everything is pointing lower for EUR/USD.

The Euro (EUR) was having a nice time during July and August, but now the tide has turned and everything is pointing lower for EUR/USD. it became clear that buyers couldn’t hold the gains above 1.12 after a couple of attempts in September, and in October it all came crashing down, which escalated further after the Republican presidential win in the US this week which sent this pair 5 cents lower.

The EUR/USD exchange rate has faced strong downward pressure over the past month due to sustained USD buying. This week, the decline intensified, with the pair dropping over 5 cents after failing to hold above the 1.12 level. Weak economic data from the eurozone has added to the euro’s struggles, particularly with Germany and France showing signs of stagnation as Q4 begins. While Germany reported a 4.2% rise in industrial orders, this followed a significant 5.4% decline the previous month.

Across the eurozone, weakening demand and a sharp drop in employment indicators—marking the biggest drop since December 2020—have worsened the economic outlook, with the European Central Bank closely monitoring these developments. New business orders and employment have both continued to decline, while Germany’s Composite Output Index showed a modest rise to a 3-month high of 48.6 in October from 47.5 in September, though it still signals contraction.

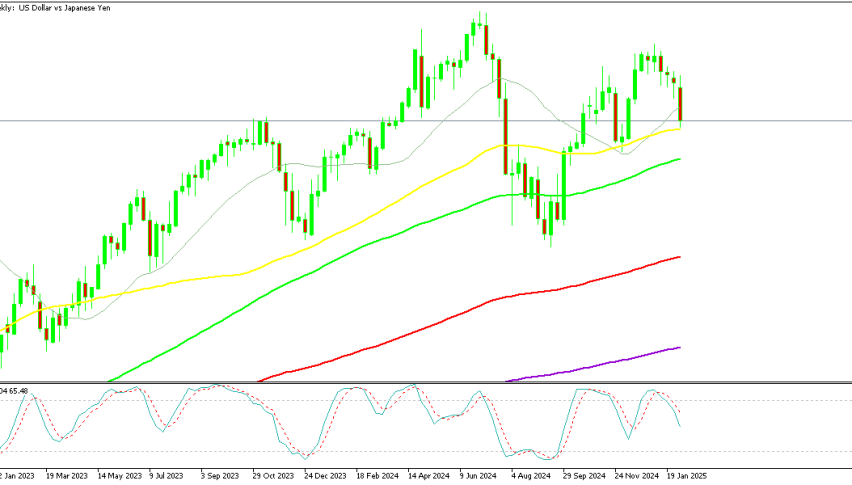

EUR/USD Chart Weekly – MAs Have Turned Into Resistance

From a technical perspective, the EUR/USD has confirmed its bearish trend after breaking below the pivot point at $1.0760, a strong support zone since July. Immediate support is now seen between $1.0660 and $1.0700, which aligns with the June low. If the pair breaks below this range, it could move further toward $1.06, the April 2024 low, potentially signaling a continuation of the downward trend. These levels will be key for traders watching for a potential rebound or further declines in the EUR/USD pair.

Germany September Industrial Production

- Monthly Change: -2.5% (actual) vs -1.0% (expected)

- Previous Month: +2.9%

Eurozone Retail Sales for October

- Monthly Change: +0.5% (actual) vs +0.4% (expected)

- Previous Reading: +0.2% (initial), revised to +1.1%

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |