USD/JPY Slips Below 149 After Martial Law from South Korea President

The decline in USD/JPY accelerated earlier, after martial law in South Korea, sending this pair 1.5 cents lower on a run for safety.

The decline in USD/JPY accelerated earlier, after martial law in South Korea, sending this pair 1.5 cents lower on a run for safety.

The USD/JPY, which had been on a strong two-month upward trend, gaining over 17 cents, has experienced significant volatility in recent weeks. After falling below 150 and 149 earlier this week, the pair managed to recover slightly, climbing back above the 149 threshold following a nearly 1-cent retracement. However, ongoing uncertainty tied to South Korea’s political instability and global risk sentiment may continue to impact the pair’s performance.

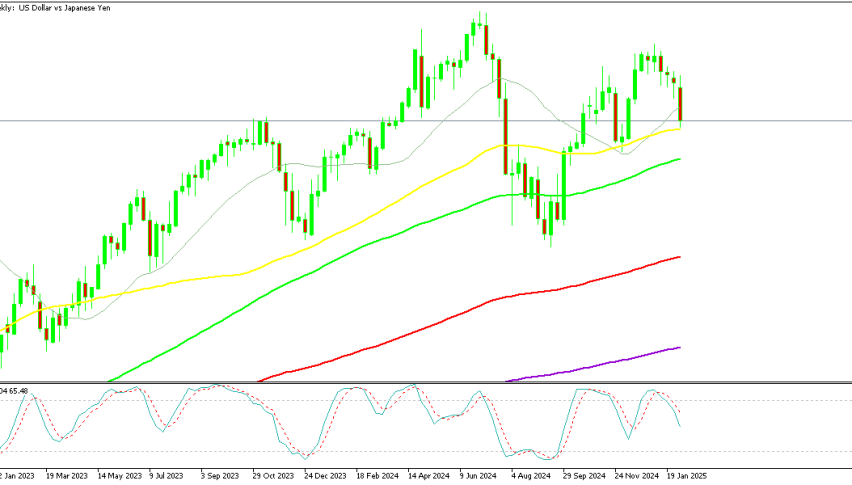

USD/JPY Chart H1 – MAs Continue to Act As Resistance

Political Turmoil in South Korea: Martial Law and Opposition Resistance

South Korean President Yoon Suk-yeol has sparked intense controversy by attempting to impose martial law, claiming it is necessary to “clear out pro-North Korean elements” and restore a “free and democratic nation.” Yoon has accused opposition parties of paralyzing government operations and vowed to uphold constitutional order while dismantling forces allegedly supporting North Korea. These provocative remarks have raised tensions significantly, particularly as budget cuts have been cited as a contributing factor to the political impasse.

The Democratic Party, South Korea’s largest opposition party, has responded fiercely. Lawmakers convened in parliament to challenge the move, with opposition leader Lee Jae-Myung denouncing Yoon’s declaration as “illegal and unconstitutional.” Lee warned that military forces might attempt to detain MPs if they sought to overturn the president’s actions. Since taking office in 2022, Yoon has struggled to advance his agenda in a parliament dominated by the opposition, further escalating political tensions.

Financial Market Impacts: Safe Haven Assets See a Boost

The political unrest has reverberated across financial markets, leading to increased demand for safe-haven assets like the Japanese yen (JPY) and Swiss franc (CHF). The heightened risk aversion pushed the USD/JPY pair below the key 149 level as investors sought refuge. U.S. Treasuries also saw increased demand, reflecting broader market caution.

The situation underscores the fragile balance between politics and market dynamics, with the unfolding events in South Korea likely to draw further scrutiny from investors and policymakers alike.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |