Silver Price Rebounds Off $30, Heads to $32 As USD Retreats After Weak US Data

Silver has been showing resilience this week, climbing $1.50, with the USD dollar in retreat, supporting the bullish momentum we predicted.

Silver has been showing resilience this week, climbing $1.50, with the USD dollar in retreat, supporting the bullish momentum we predicted on Monday.

As the Federal Reserve prepares for its final rate hike of 2024, silver prices have dropped $5 from recent highs over the past two months. However, the metal has found strong support around the $30 level, with the 100 SMA (red) on the daily chart acting as a key technical floor. Renewed buying interest in this zone has halted the sharp sell-off that ended late last week.

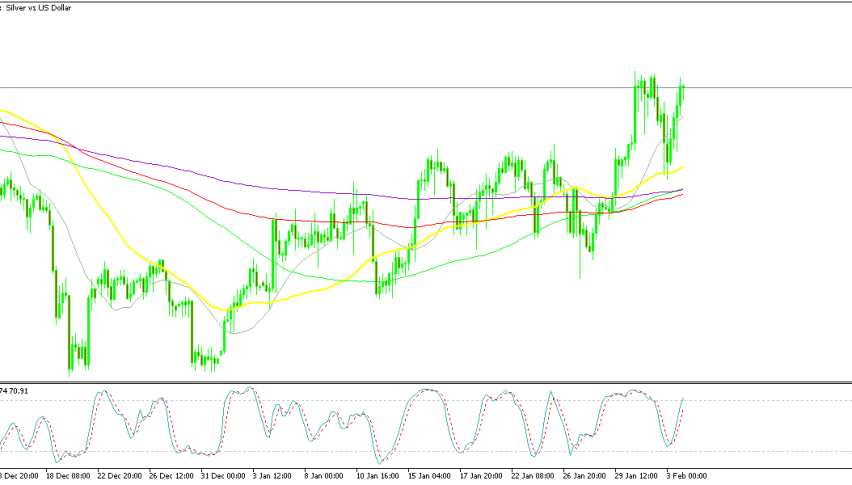

Silver Chart Daily – The 100 SMA Holds As Support

Signs of Recovery and Bullish Momentum for XAG/USD

Silver has shown signs of recovery this week, with a hammer candlestick pattern—a classic bullish reversal signal—emerging after the recent retreat. The upward momentum strengthened yesterday, fueled by weak US economic data. The ISM Services Index revealed a sharper-than-expected contraction, reflecting cooling demand and employment in the services sector. Additionally, the ADP report highlighted slower job growth in both goods and services, signaling a softening labor market.

Economic Data Supports Silver’s Outlook

The weakening economic data has eased concerns about aggressive monetary tightening, providing a boost to silver as a safe-haven asset. With supportive technical indicators and shifting market sentiment, silver’s outlook appears increasingly positive heading into the year’s final stages.

Silver Technical Analysis

Silver (XAG/USD) declined to $30.43 yesterday before stabilizing and climbing to $31.46, marking an intraday gain of approximately 1%. This movement reflects the interplay of global economic concerns and growing expectations for a U.S. interest rate cut. Amid economic uncertainty, safe-haven assets like silver continue to attract investor interest.

Market sentiment has shifted toward a higher probability of monetary easing, with a 75% chance now priced in for a 25 basis point rate cut in December, up from 70% following weaker-than-expected U.S. economic data. This expectation could further boost non-yielding assets such as silver, even as the Federal Reserve signals a longer-term policy of elevated interest rates, with only two modest cuts anticipated in 2025. Technically, silver faces resistance near the $31.70 level, where the 50-day SMA (yellow) serves as a potential barrier for buyers aiming to extend the recent rally.

Silver Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |