Forex Signals Brief January 27: FED, ECB and BOC Meetings and Tariff Talk Highlight the Week

This week we have the FED, BOC, and ECB meetings, with the last two expected to cut interest rates, while markets are also expecting some...

Live BTC/USD Chart

This week we have the FED, BOC, and ECB meetings, with the last two expected to cut interest rates, while markets are also expecting some tariff talk from Donald Trump, after announcing tariffs and sanctions on Colombia over the weekend.

Market Recap: Stocks Rally While US Dollar Declines

The US dollar traded lower last week following President Donald Trump’s speech at the World Economic Forum (WEF) in Davos, where he made only brief mentions of tariffs. In contrast, the S&P500 reached a historic milestone, closing above 6,100 points for the first time, driven by improved risk sentiment. However, Trump’s comments urging lower crude oil prices pressured the energy market, with WTI crude ending the week $4 lower.

Adding to the USD’s weakness, Friday’s economic data painted a softer picture, with the US Services PMI showing a significant slowdown and the Michigan consumer sentiment index falling below expectations.

Despite the Bank of Japan’s widely expected 25 basis point rate hike, the US dollar continued its downward trend against major currencies, with USD/JPY showing little change. Meanwhile, EUR/USD briefly surpassed 1.05 but ultimately closed below that level.

Stock Market Performance:

For the second consecutive week, major US stock indices ended higher:

- The Dow Jones Industrial Average rose 2.2%

- The S&P 500 gained 1.8%

- The NASDAQ advanced 1.7%

- The Russell 2000 climbed 1.4%

Cryptocurrency Market:

Bitcoin (BTC/USD) traded within a range last week, maintaining levels above $100,000. It achieved a new all-time high of $109,870 before pulling back slightly to end the week lower, however it has established a support zone around $100K which seems like a good place to by BITCOIN . Gold was bullish all week and approached the all-time high at $2,790, but buyers got cold feet before markets closed.

This Week’s Market Expectations

This week we have three min central banks holding meeting, with the ECB and the BOC expected to deliver a25bps rate cut, while the FED is expected to keep interest rates on hold this time. That should have kept EUR/USD bearish last week, but politics are more important right now. So, the volatility will depend on tariffs rhetoric or actions from the White House.

Upcoming Economic Events – Key Releases to Watch

Monday:

- China PMI Data:

- Insights into China’s manufacturing and services sector performance.

- Could influence global market sentiment and commodity prices.

- German IFO Business Climate Index:

- Measures business sentiment and expectations in Germany.

- A key indicator of economic health in the Eurozone’s largest economy.

Tuesday:

- US Durable Goods Orders:

- Tracks new orders for long-lasting manufactured goods.

- Provides insights into business investment trends.

- US Consumer Confidence:

- Gauges consumer sentiment on current and future economic conditions.

- Affects consumer spending outlook, a major driver of the US economy.

Wednesday:

- Australia Q4 CPI (Inflation Report):

- Key data for the Reserve Bank of Australia’s policy direction.

- Higher-than-expected inflation could lead to potential rate hikes.

- Bank of Canada (BoC) Policy Decision:

- Interest rate announcement and economic outlook assessment.

- Impact on CAD exchange rates and market expectations for monetary policy.

- FOMC (Federal Reserve) Policy Decision:

- Interest rate decision and forward guidance.

- Key focus on inflation outlook and potential rate cuts or pauses.

Thursday:

- Eurozone Q4 GDP and Unemployment Rate:

- Indicates the economic health and labor market conditions in the Eurozone.

- GDP growth trends could influence ECB’s future policy stance.

- European Central Bank (ECB) Policy Decision:

- Interest rate guidance and commentary on inflation.

- Key driver for EUR movement and Eurozone financial markets.

- US Q4 GDP Growth:

- A major indicator of economic expansion or contraction.

- Market reaction could influence USD strength and Fed policy.

- US Weekly Jobless Claims:

- Tracks new unemployment claims, offering insights into labor market trends.

- A consistent rise could signal economic slowdown concerns.

Friday:

- Japan Economic Data Releases:

- Tokyo CPI: Measures inflation trends in Japan’s capital, often a leading indicator.

- Unemployment Rate: Provides insights into labor market stability.

- Industrial Production & Retail Sales: Reflects manufacturing strength and consumer spending patterns.

- Swiss Retail Sales:

- Indicator of consumer spending trends in Switzerland, impacting CHF sentiment.

- French & German CPI Reports:

- Inflation readings from two major Eurozone economies.

- Crucial for ECB’s future policy outlook.

- Canada GDP:

- Key growth indicator for the Canadian economy.

- Impacts CAD movements and BoC policy expectations.

- US Core PCE (Personal Consumption Expenditures):

- The Fed’s preferred inflation gauge, critical for rate decisions.

- A higher-than-expected reading may prompt hawkish Fed actions.

- US Q4 ECI (Employment Cost Index):

- Measures wage growth and benefits costs.

- Closely watched for inflationary pressures in the labor market.

Last week the volatility went against the US dollar, with some strong buying momentum in risk assets such as commodity currencies and stock markets. We opened 26 trading signals in total, remaining mostly long on stocks and Gold, and ending the week with 19 winning forex signals and 7 losing ones.

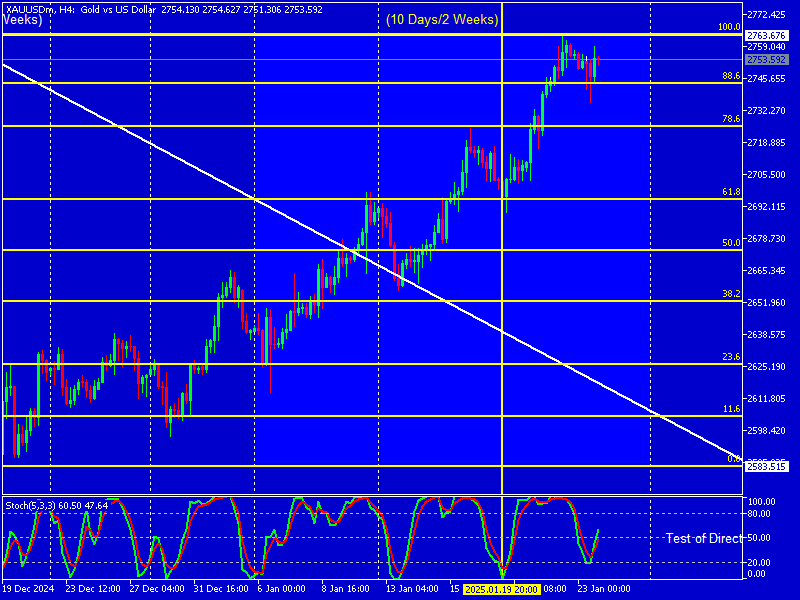

Gold Retreats Below ATH

Gold continued to make strong gains last week after rebounding strongly this month and establishing firm support around the $2,600 level. IN December, prices declined by $100 following an unsuccessful attempt to breach the critical $2,725 resistance zone. However, the market found stability near the 20-week SMA, with a doji candlestick signaling a potential bullish reversal. This was confirmed by three consecutive bullish weekly closes, pushing gold above $2,700 at the start of the week. On the H4 chart, moving averages are acting as support. A slight pullback occurred yesterday morning, but buying interest resumed above the 20 SMA (gray), leading to a profitable long position.

XAU/USD – H4 Chart

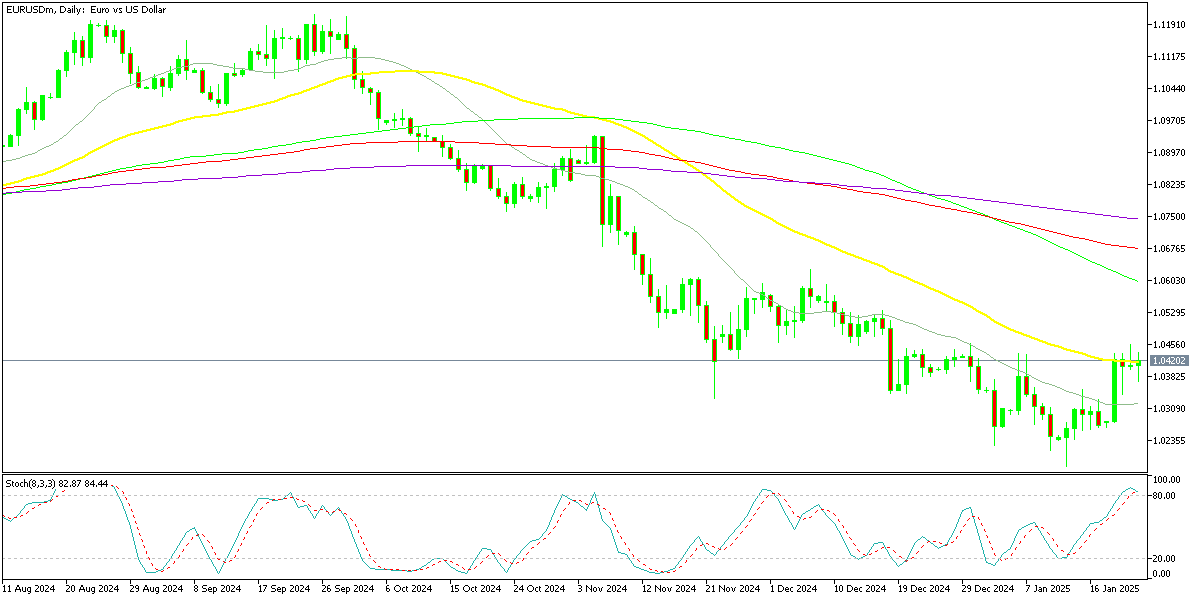

EUR/USD Hesitates at 1.05 Ahead of the EC Rate Cut

The EUR/USD pair has faced consistent selling pressure since late September, shedding nearly 10 cents from levels above 1.11. However, Monday saw a strong bullish rally fueled by a weaker US dollar. During the US trading session, the pair briefly reached 1.2456 on the daily chart but struggled to sustain gains above the 50-day SMA. Following President Trump’s speech at Davos, renewed buying interest pushed the price back above this moving average, signaling potential upward momentum.

EUR/USD – Daily Chart

Cryptocurrency Update

Positive Comments From US Senator Can’t Send Bitcoin Above $110K

Bitcoin has experienced notable price fluctuations in recent sessions. After starting the week near $108,000, a 25 basis point rate cut contributed to a sharp decline, with prices dipping into the low $90,000s and briefly falling below $100,000. An attempted recovery to $95,000 met resistance at the 20-day SMA, leading to another downturn. Despite these fluctuations, Bitcoin surged 10% to a new high on early last week to reach a new high just below $110K, before consolidating above the $100,000 mark. Ongoing buying interest and bullish commentary from Republican Senator Lummis, who hinted at significant developments in the crypto space, have helped Bitcoin sustain its positive momentum.

BTC/USD – Daily chart

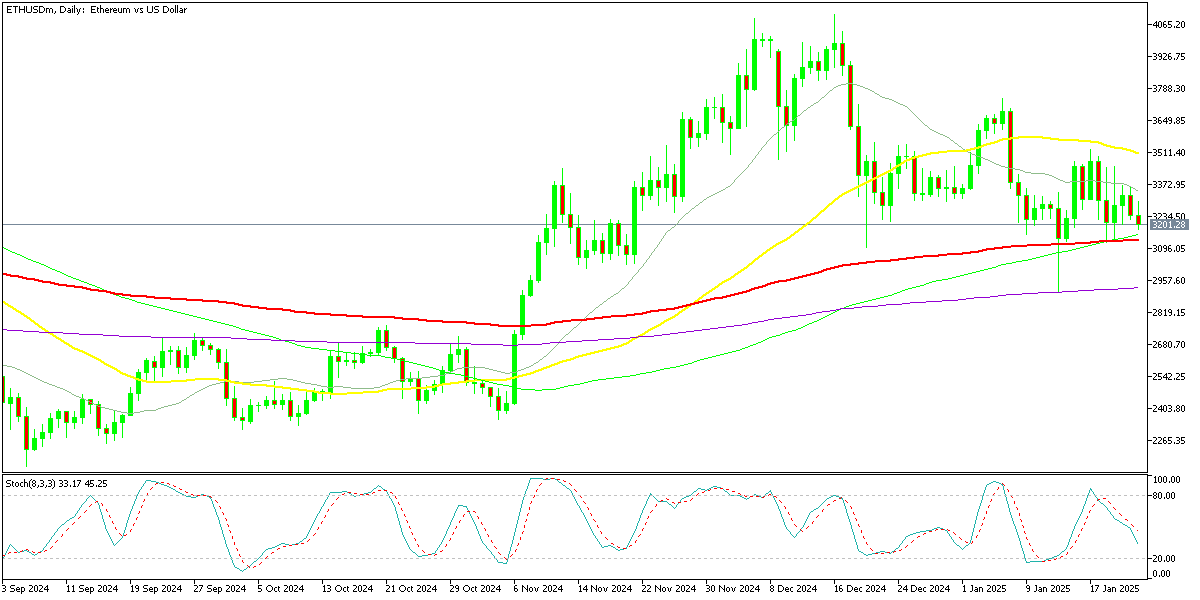

Ethereum Stuck between MAs

Ethereum has also seen substantial volatility in recent weeks. After initially finding support near the 50-day SMA, selling pressure pushed ETH below $3,500 and later under the $3,200 level. During Monday’s market-wide downturn, ETH briefly dipped below $3,000 before fresh buying activity triggered a recovery. However, despite a mid-week rally to $4,000, Ethereum faced resistance and dropped back below $3,000. The broader strength of the crypto market over the past two weeks has provided support, allowing ETH to reclaim levels above $3,500, though the 20-day SMA remains a key resistance point.

ETH/USD – Weekly Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |