Forex Signals Brief January 28: Will We See A Rebound in Cryptos and Equities Today?

Yesterday we saw the largest market cap wipeout in Nvidia stock and cryptos dived to, but XRP bounced late so we might see a bullish rebound

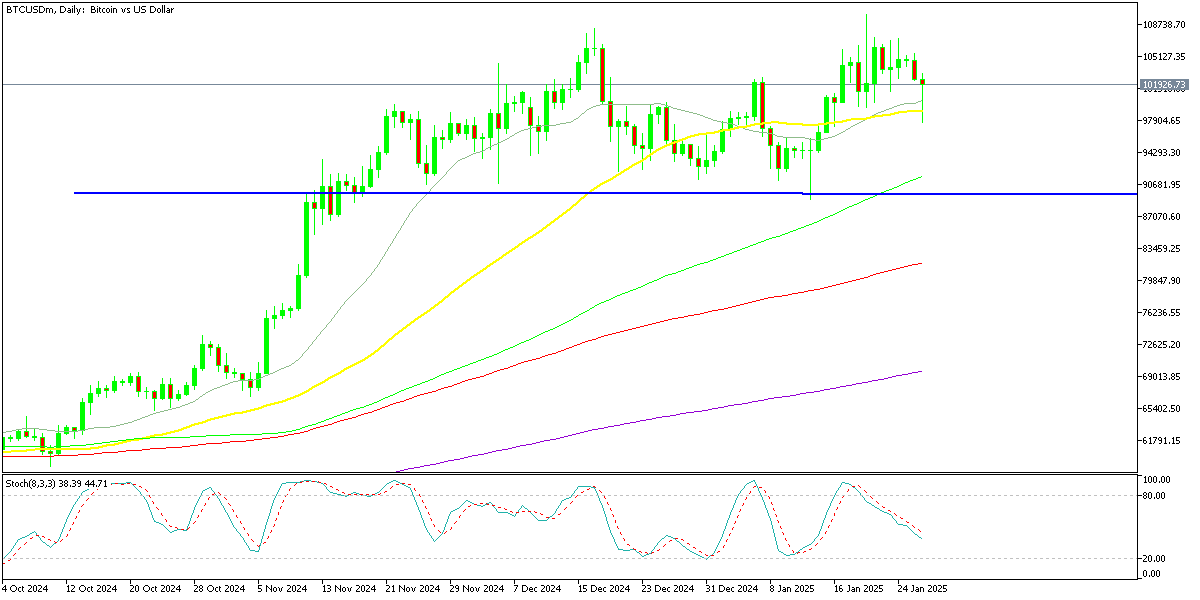

Live BTC/USD Chart

Yesterday we saw the largest market cap wipeout in Nvidia stock and cryptos dived too, but XRP bounced late to reclaim all losses while stocks also recuperated most of the losses, so we might see a bullish rebound today.

Markets Start the Week on a Weak Note Amid Tariff Concerns and Deep Seek Launch

Yesterday saw a rough beginning to both the day and the week as markets reacted to Donald Trump’s announcement of tariffs on Colombia. Investors interpreted this move as a potential precursor to broader duties on other nations, sparking uncertainty. Adding to the gloomy sentiment was weak economic data from China, signaling a slowdown in the services sector. These developments weighed heavily on global stock markets, intensifying the sell-off.

Nvidia’s stock took center stage, plummeting 17% and setting a record for the largest single-day market capitalization loss in history. The sharp decline was triggered by news of DeepSeek’s development of a more cost-effective and efficient AI model, challenging Nvidia’s dominance in the AI sector. This prompted a broader market reassessment of AI economics, affecting a wide range of industries.

The initial market reaction was marked by a flight to safety, with the Japanese yen and Swiss franc strengthening and Treasury yields falling by 10 basis points. However, as the day progressed, sentiment began to improve in certain sectors, particularly those linked to the real economy. Optimism around more accessible AI technologies contributed to a recovery in commodities-linked currencies, and the Dow managed to erase early losses, closing in positive territory.

In the currency markets, USD/JPY regained 1 cent after the 2.5 cent fall, as optimism gradually returned. Cryptocurrencies also showed signs of recovery after being dragged lower by negative sentiment in equities. Bitcoin briefly fell below the $100,000 level on a $7,000 decline but rebounded to hold above this key support. Meanwhile, Ripple suffered a sharp 20% loss during the session but managed to recover all of its losses, ending the day above $3.

Today’s Market Expectations

Yesterday Nikkei was one of the biggest losers, although it still remained within the ascending channel, while other stock markets rebounded late in the day. This is a positive signal after the initial shock, which also translated into a bounce in cryptocurrencies. So, chances are that Bitcoin nd Ripple will continue to move higher today.

The anticipated US consumer confidence figure is expected to rise to 106.0, rebounding slightly from last month’s decline to 104.7. This drop in December marked a significant decrease from November’s robust 112.8. According to the Conference Board, “The recent consumer confidence rebound was not sustained in December as the Index fell back to the middle of the range that has prevailed over the past two years.” The most significant contributor to December’s decline was the expectations component, though weaker consumer evaluations of both current conditions and future outlooks also played a role. While consumer perceptions of the labor market continued to show improvement—aligning with positive trends in jobs and unemployment data—views on business conditions worsened. This data suggests a cautious consumer sentiment heading into the new year, with labor market resilience providing some optimism but uncertainty in broader business conditions tempering confidence.

Last week the volatility went against the US dollar, with some strong buying momentum in risk assets such as commodity currencies and stock markets. We opened 26 trading signals in total, remaining mostly long on stocks and Gold, and ending the week with 19 winning forex signals and 7 losing ones.

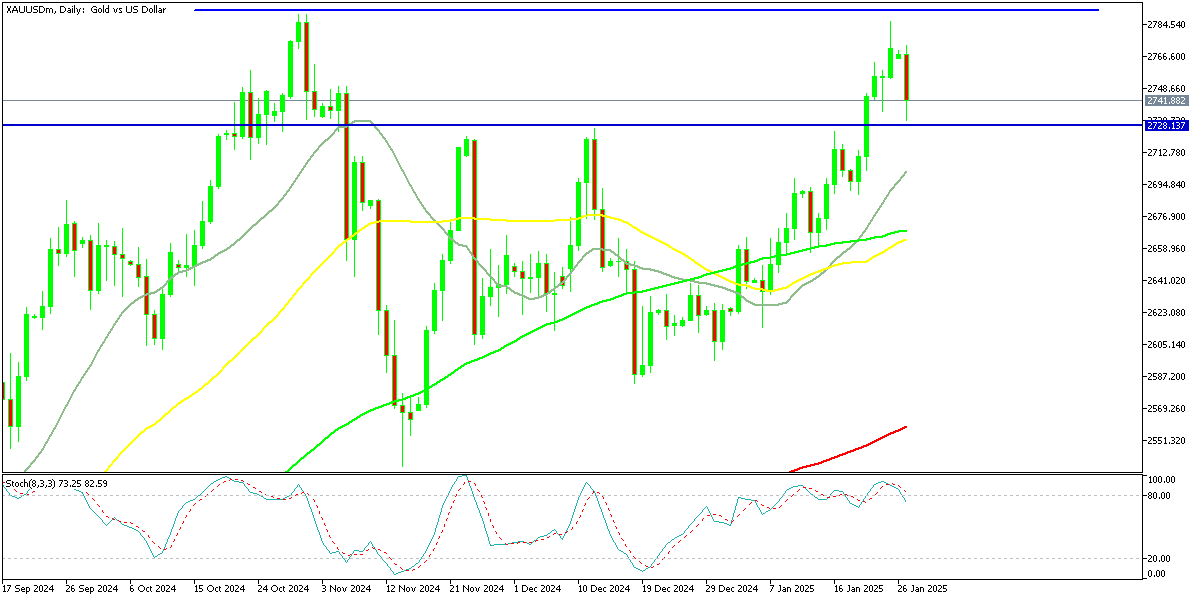

Gold Retreats Below ATH

Gold continued to make strong gains last week after rebounding strongly this month and establishing firm support around the $2,600 level. IN December, prices declined by $100 following an unsuccessful attempt to breach the critical $2,725 resistance zone. However, the market found stability near the 20-week SMA, with a doji candlestick signaling a potential bullish reversal. This was confirmed by three consecutive bullish weekly closes, pushing gold above $2,700 at the start of the week. On the H4 chart, moving averages are acting as support. A slight pullback occurred yesterday morning, but buying interest resumed above the 20 SMA (gray), leading to a profitable long position.

XAU/USD – H4 Chart

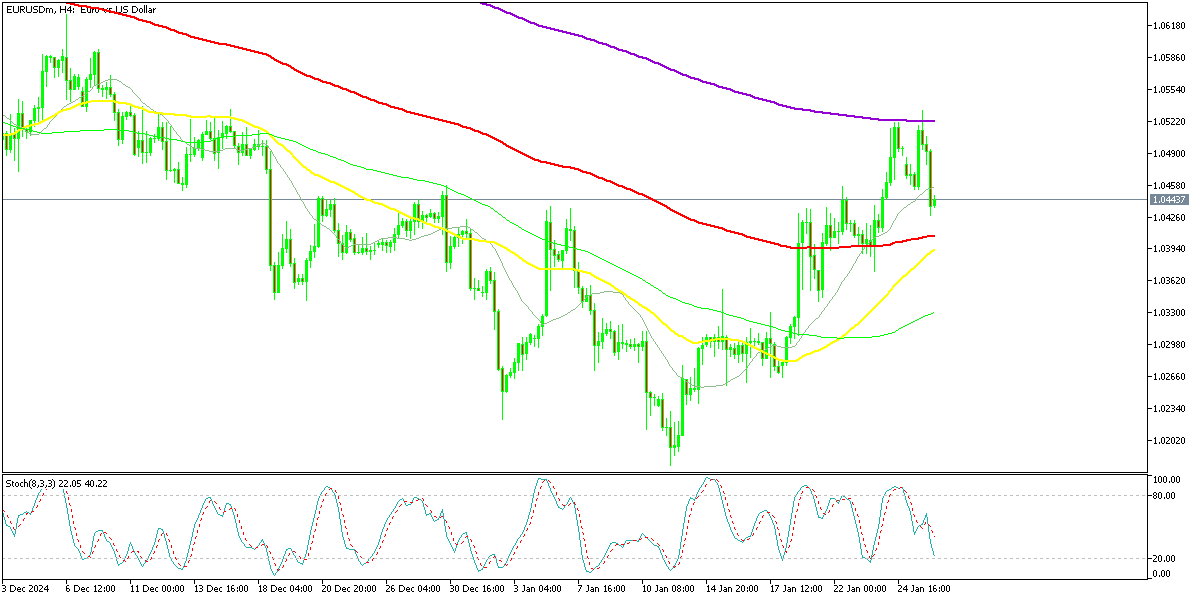

EUR/USD Hesitates at 1.05 Ahead of the EC Rate Cut

The EUR/USD pair has faced consistent selling pressure since late September, shedding nearly 10 cents from levels above 1.11. However, Monday saw a strong bullish rally fueled by a weaker US dollar. During the US trading session, the pair briefly reached 1.2456 on the daily chart but struggled to sustain gains above the 50-day SMA. Following President Trump’s speech at Davos, renewed buying interest pushed the price back above this moving average, signaling potential upward momentum.

EUR/USD – Daily Chart

Cryptocurrency Update

Positive Comments From US Senator Can’t Send Bitcoin Above $110K

Bitcoin has experienced notable price fluctuations in recent sessions. After starting the week near $108,000, a 25 basis point rate cut contributed to a sharp decline, with prices dipping into the low $90,000s and briefly falling below $100,000. An attempted recovery to $95,000 met resistance at the 20-day SMA, leading to another downturn. Despite these fluctuations, Bitcoin surged 10% to a new high on early last week to reach a new high just below $110K, before consolidating above the $100,000 mark. Ongoing buying interest and bullish commentary from Republican Senator Lummis, who hinted at significant developments in the crypto space, have helped Bitcoin sustain its positive momentum.

BTC/USD – Daily chart

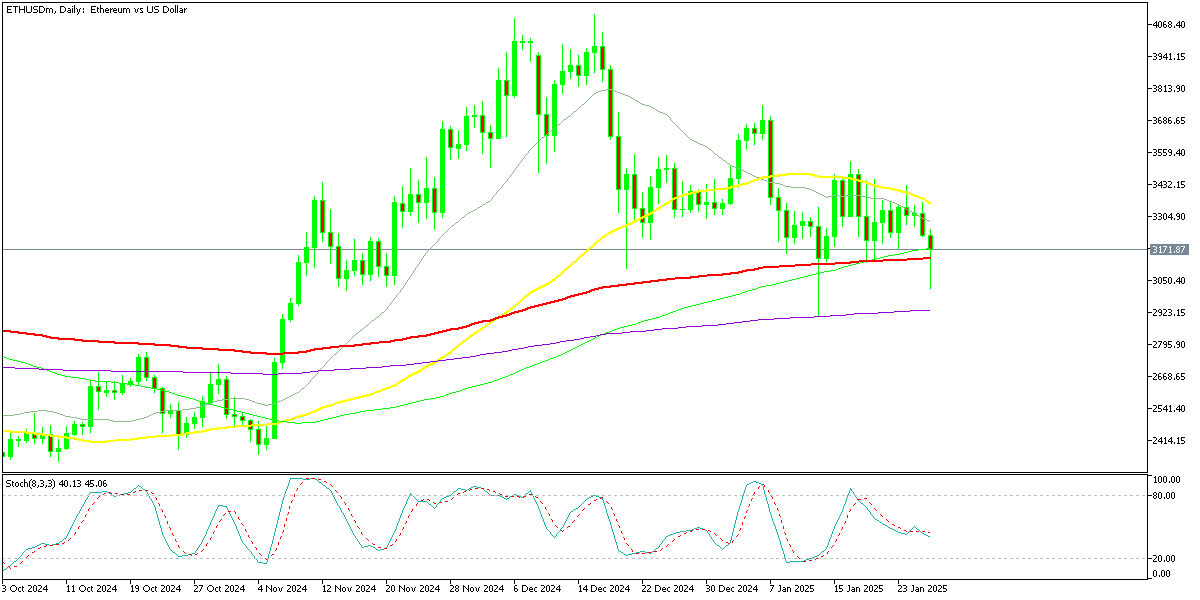

Ethereum Stuck between MAs

Ethereum has also seen substantial volatility in recent weeks. After initially finding support near the 50-day SMA, selling pressure pushed ETH below $3,500 and later under the $3,200 level. During Monday’s market-wide downturn, ETH briefly dipped below $3,000 before fresh buying activity triggered a recovery. However, despite a mid-week rally to $4,000, Ethereum faced resistance and dropped back below $3,000. The broader strength of the crypto market over the past two weeks has provided support, allowing ETH to reclaim levels above $3,500, though the 20-day SMA remains a key resistance point.

ETH/USD – Weekly Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |