Booking Profit in USD/CAD Long, After Dovish BOC Rate Cut

USD/CAD has popped 80 cents higher today after the 25 bps Bank of Canada rate cut, which will be followed by the FED meeting later today.

Live USD/CAD Chart

USD/CAD has popped 80 cents higher today after the 25 bps Bank of Canada rate cut, which will be followed by the FED meeting later today.

The BOC’s decision was in line with expectations, signaling a controlled approach to monetary easing rather than an aggressive cutting cycle. The end of QT and the gradual resumption of asset purchases suggest an effort to maintain liquidity and financial stability. However, trade policy uncertainties, particularly tariffs, remain key risks, influencing future rate decisions. Markets now await further economic data and central bank signals to gauge the pace of future cuts.

Bank of Canada Rate Decision & Policy Outlook and Macklem’s opening statement

- Interest Rate Cut:

- The Bank of Canada (BOC) cut its policy rate by 25 basis points, bringing it down to 3.00% from 3.25%.

- The move was fully anticipated, with markets having priced in a 99% probability of a cut ahead of the decision.

- Market Expectations & Easing Outlook:

- Before the announcement, markets expected 68.5 basis points of total easing for 2025.

- After the decision, expectations only slightly adjusted to 67.6 bps, signaling that markets had largely anticipated the move.

- End of Quantitative Tightening & Balance Sheet Expansion:

- The BOC confirmed the end of quantitative tightening (QT), marking a shift in policy.

- Asset purchases will resume in early March, starting gradually to stabilize and then modestly expand the central bank’s balance sheet.

- Policy Justification & Future Considerations:

- The BOC emphasized the substantial rate reductions since June, suggesting a cautious approach moving forward.

- Officials stressed they will closely monitor tariff developments and assess their potential impact on economic activity and inflation.

With no immediate tariff developments, the outlook remains unclear, which is understandable given ongoing economic uncertainties. However, projections from the Monetary Policy Report (MPR) suggest that if the U.S. imposes 25% tariffs and other restrictive measures, Canada’s GDP growth could decline by approximately 2.5 percentage points in the first year. Additionally, a weaker Canadian dollar (loonie) could contribute to inflationary pressures, further complicating the economic landscape.

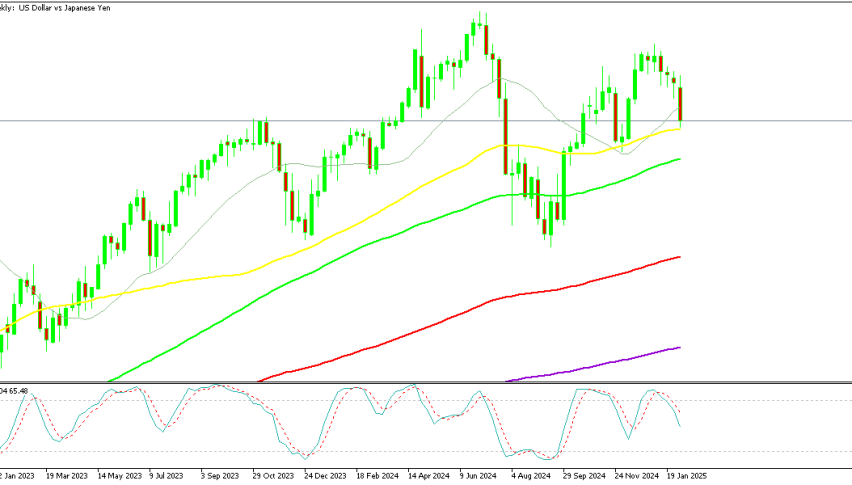

In currency markets, USD/CAD surged by 80 pips, reaching a one-week high near 1.4471, supported by a stronger U.S. dollar. Despite this increase, the pair remains within a narrow trading range, reflecting market caution ahead of major central bank decisions later this week. On the weekly chart, technical indicators continue to provide support. The 50-day Simple Moving Average (SMA) has now taken control, helping stabilize the price above 1.42 as the pair consolidates.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |