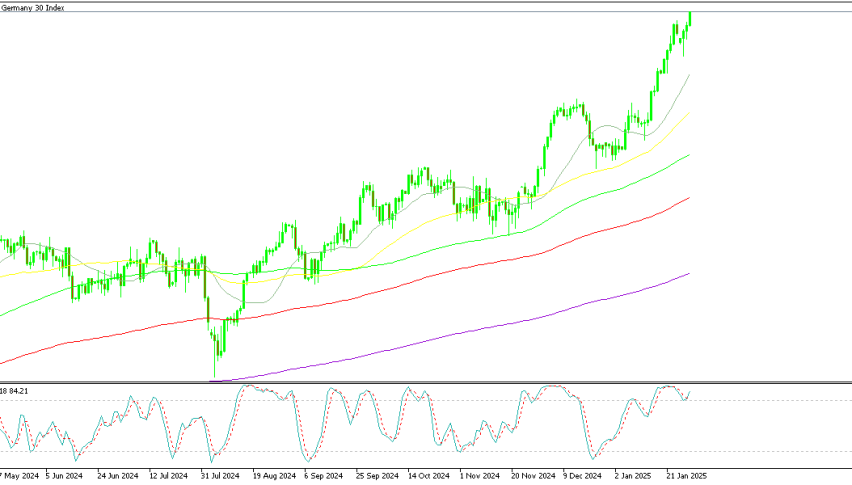

Record High in Dax 40 Ahead of ECB Cut, Forgetting DeepSeek Dive

The German index DAX was little affected by the market crash following DeepSeek and it has printed a new record high today, ahead of the ECB

Live DAX Chart

The German index DAX was little affected by the market crash following DeepSeek and it has printed a new record high today, as markets await the ECB rate cut tomorrow.

DAX Rallies Amid AI Stock Rebound and Market Resilience

The DAX index rebounded strongly, erasing Monday’s losses with a 0.7% gain on Tuesday and climbing another 1% today. This recovery was fueled by renewed demand for AI-linked stocks, as market concerns over DeepSeek’s disruptive impact on the sector eased.

DeepSeek, an AI company with a low-cost model, had triggered market turbulence after surpassing ChatGPT in Apple’s App Store downloads. Investors initially worried about the sustainability of AI investment and the valuation of major US tech firms, leading to a sharp decline in US stock indices. However, while Nasdaq experienced a steep sell-off, the DAX remained resilient, even finishing flat on Monday—a sign that buying pressure remained strong.

Global Influence Fuels DAX’s Strength

Despite economic struggles in Germany’s domestic market, the DAX 40 index has continued to set new record highs, defying expectations. This disconnect between stock market performance and national economic health has puzzled many traders. However, the DAX’s international exposure makes it less of a reflection of the German economy and more of a global market indicator. Notably, only 20% of the revenue from the index’s key components comes from Germany, with US market influence playing a significant role in its movements.

One of the strongest contributors to the DAX’s upward momentum has been SAP, which posted an impressive 70% gain in 2024. Additionally, Siemens Energy AG rebounded 7.5% yesterday, extending gains today. During Monday’s sell-off, Siemens had initially plunged 20%, but the dip presented a buying opportunity, especially after the company’s preliminary Q1 revenue figures exceeded expectations.

Meanwhile, Germany’s GfK Consumer Confidence Index dropped to -22.4, missing forecasts and signaling ongoing consumer struggles. This weak sentiment could push the European Central Bank (ECB) toward a more dovish stance, potentially boosting the DAX further as investors anticipate looser monetary policy.

Dax 40 Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |