AUDUSD Waiting for A Bearish Break As RBA Prepares to Cut Rates

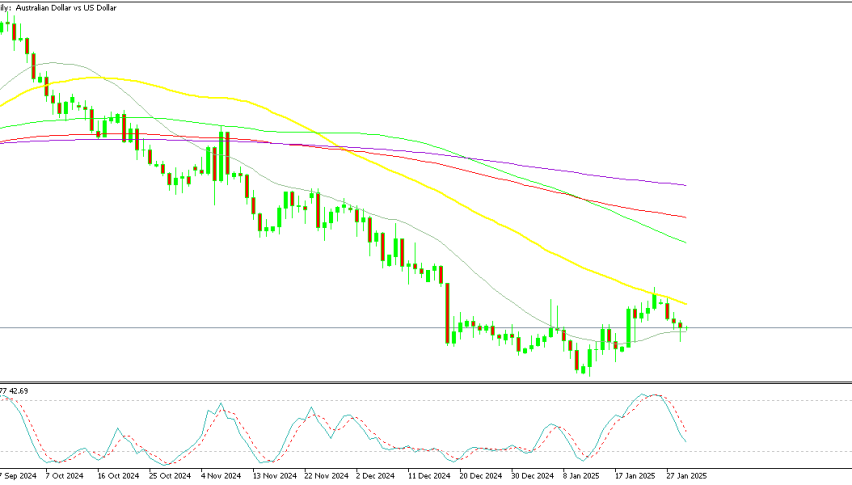

Almost everyone is expecting the RBA to cut interest rates in February, however, AUD/USD is still holding above the 20 daily SMA.

Live AUD/USD Chart

Almost everyone is expecting the RBA to cut interest rates in February, however, AUD/USD is still holding above the 20 daily SMA which is acting as support, while import prices came weaker, signaling a further decline in Australian inflation.

After Trump’s tariff deferral led to a softer USD, the AUD/USD pair showed initial signs of recovery last week. However, it has since lost one cent this week and the price headed to the $0.62 level yesterday, encountering new negative momentum. The $0.63 mark—which was the high from last Friday—along with the 50-day SMA, now presents immediate resistance. On the downside, support is located at $0.62 where the 20 SMA (gray) stands, and if selling pressure intensifies, further support can be found between $0.6150 and $0.61.

National Australia Bank (NAB) is predicting a rate cut by the Reserve Bank of Australia (RBA) in February. Along with the other three major Australian banks—ANZ, Commonwealth Bank of Australia (CBA), and Westpac—NAB is forecasting a 25 basis point reduction in the RBA cash rate on February 18. The current RBA cash rate stands at 4.35%, with markets assigning almost an 80% probability that it will drop to 4.1% following the meeting.

According to ANZ, the RBA is likely to lower rates in February, supported by the latest trimmed mean inflation data, which indicates that annualized inflation over the past six months has returned to within the RBA’s target range. The bank believes inflationary pressures have eased sufficiently, allowing for a rate cut. Weaker economic growth in 2024 has further helped to alleviate inflation, contributing to the decision.

Additionally, the recent import and export price data released today should give the RBA more confidence, as these figures suggest that underlying inflation is steadily falling toward the target range. With the economic landscape showing signs of slowing, especially in terms of pricing pressures, it seems the central bank is positioned to act on these trends, potentially signaling the beginning of an easing cycle.

Australia’s Q4 2024 Terms of Trade: Mixed Results with Export Price Recovery and Slower Import Price Growth

Import Price Index:

- Quarterly (Q/Q): +0.2% (missed expectations of +1.5%).

- Previous Quarter (Q3): -1.4% (indicating a slight rebound).

- Yearly (Y/Y): -1.9%, showing continued weakness in import costs on an annual basis.

Export Price Index:

- Quarterly (Q/Q): +3.6% (beat expectations of +2.5%).

- Previous Quarter (Q3): -4.3% (marking a strong recovery).

- Yearly (Y/Y): -8.6%, reflecting persistent declines in export prices over the past year.

Australia’s terms of trade for Q4 showed a mixed performance, with export prices rebounding strongly, while import prices saw only a slight increase that fell short of expectations. The 3.6% rise in export prices marks a partial recovery from the previous -4.3% decline, likely driven by improved commodity prices or stronger external demand. However, despite this quarterly improvement, year-on-year declines in both exports (-8.6%) and imports (-1.9%) point to long-term trade challenges, possibly stemming from slower global growth and weaker demand for Australian exports.

The weaker-than-expected Import Price Index suggests that imported inflation remains subdued, which could help ease cost pressures for both businesses and consumers. This data provides the Reserve Bank of Australia (RBA) with some insight into the economic landscape, indicating that external trade conditions may be improving. However, the weak recovery in import prices could dampen concerns over inflation, reducing immediate pressure on the RBA to act aggressively on interest rates.

The sustained recovery in export prices could provide economic support, especially for resource-dependent industries in Australia. This improvement in exports could help maintain economic stability in the face of global uncertainty. Additionally, the Australian dollar (AUD) might find short-term support from stronger export prices, but ongoing risks related to global demand trends will remain a critical factor for currency movements.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Sidebar rates

82% of retail CFD accounts lose money.

Related Posts

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |