Dogecoin Price News: DOGE Bounces off Key Trend Line Support, Will It Keep Rallying?

Technical indicators suggest potential for continued upward movement as Dogecoin finds support at critical levels

Quick overview

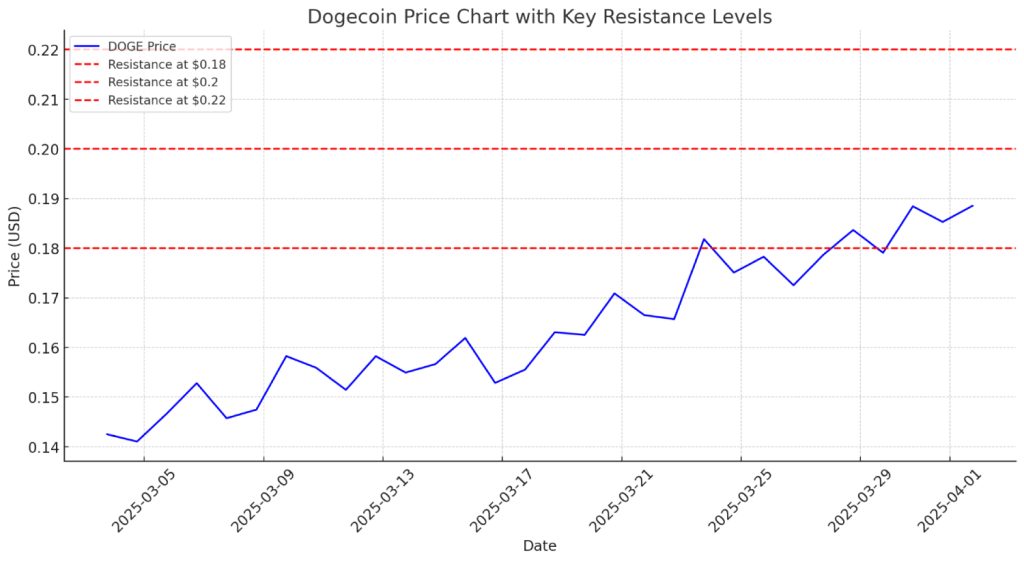

- Dogecoin has bounced off a key trend line support level at $0.15, indicating potential for continued upward movement.

- Recent technical analysis shows strong accumulation at support levels, with increased trading volume of approximately 23% in the last 24 hours.

- Traders are monitoring key resistance levels at $0.18, $0.20, and $0.22, which could determine Dogecoin's next price action.

- Fundamental factors, including community support and endorsements, may sustain interest in Dogecoin beyond short-term trading.

Live DOGE/USD Chart

Dogecoin DOGE/USD has bounced off a key trend line support level, suggesting that the meme coin could continue its rally in the coming days. The cryptocurrency, which initially gained popularity as a joke, has shown remarkable resilience in recent market conditions.

Technical Analysis Shows Strong Support

According to recent technical analysis, Dogecoin found solid support at the $0.15 level, which coincides with an upward-sloping trend line that has been in place since early February. This bounce off support indicates that buyers are stepping in at these levels, potentially setting up DOGE for continued upward movement.

“The recent price action in Dogecoin suggests strong accumulation at key support levels,” noted cryptocurrency analyst Michael Roberts. “The bounce occurred precisely at the convergence of multiple technical indicators, which often signals a continuation of the prevailing trend.”

Broader Market Context

Dogecoin’s recovery comes amid a broader cryptocurrency market that has been showing signs of strength. Bitcoin recently crossed the $70,000 threshold, while Ethereum has been trading steadily above $3,700. These positive movements in major cryptocurrencies often provide tailwinds for altcoins like Dogecoin.

Market data indicates that trading volume for DOGE has increased by approximately 23% in the past 24 hours, suggesting growing interest from traders and investors. This surge in volume, coupled with the technical bounce, could potentially fuel further price increases in the short term.

Key Resistance Levels to Watch

Looking ahead, traders are closely monitoring several key resistance levels that could determine Dogecoin’s next move:

- Immediate resistance: $0.18

- Secondary resistance: $0.20 (psychological level)

- Major resistance: $0.22 (previous swing high)

Breaking above these levels could potentially accelerate the upward momentum, while failure to overcome them might result in a period of consolidation or a retest of support levels.

Fundamental Factors

Beyond technical indicators, several fundamental factors could be contributing to Dogecoin’s recent price action. The cryptocurrency continues to benefit from a loyal community of supporters and occasional endorsements from high-profile figures like Elon Musk.

Additionally, ongoing developments in the Dogecoin ecosystem, including potential integrations with various platforms and services, could provide sustained interest in the meme coin beyond short-term speculative trading.

Conclusion

While cryptocurrency markets are inherently volatile and unpredictable, the current technical setup for Dogecoin appears favorable for continued upward movement in the near term. The bounce off key trend line support, combined with increasing volume and broader market strength, suggests that DOGE could maintain its positive momentum.

Traders and investors should, however, remain cautious and implement appropriate risk management strategies given the historically high volatility of cryptocurrencies in general and meme coins in particular.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Related Articles

Comments

Sidebar rates

82% of retail CFD accounts lose money.

Add 3442

Related Posts

XM

Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |